Evidence-Based M&A Analysis and Advice

We reveal the dependencies of M&A deal terms to position you for better outcomes

AI Schema is a Financial Technology Company Commercializing New Methods of M&A Analysis and Advice

We help buyers and sellers win deals faster and better

Learn More“We utilize proprietary technology to help solve M&A problems. We reveal the dependencies of M&A deal terms and conditions based on hard facts.” – Haoran Li, Co-Founder

Traditional M&A advice is often just a summary of advisers’ biased personal experiences

You pay a steep price for M&A deal advice that is wrong

AI Schema seeks to eliminate M&A behavioral biases and improve deal execution, risk assessment and outcomes

Our methods can be applied to all industry sectors and deal sizes

M&A Analysis and Advice Should be Based on More Than Personal Experience and Small Samples

“Play the odds when they’re in your favor. Have a plan in place when they’re not. You can beat the game knowing the rules.”

-Nir Yarden, Co-Founder

Learn MoreBusiness and legal terms don’t appear in deals randomly

Assessing deal term dependency is critical to making well informed M&A decisions

We reveal the dependencies of M&A deal terms and conditions to position you for better outcomes

We reveal hidden information and patterns absent in traditional M&A analysis and advice

Our recommendations are grounded in facts, not opinions or guesses

We generate asymmetric M&A deal information to help you improve deal analysis, negotiations and outcomes

Separate Facts from Fiction

Faster and better M&A deal analysis, negotiations and outcomes

Learn MoreYou gain better predictive powers

You gain new methods to conditionally test assumptions and likely success

You gain new bargaining powers throughout deal

You test validity of adviser recommendations and counterparty arguments scientifically

You save time, money and effort

See How AI Schema Supports All Phases of the M&A Deal Process

Phase 1

Investigate Market OpportunitiesPhase 2

M&A Opportunity EmergesPhase 3

Internal M&A Deal PlanningPhase 4

Deal ExecutionPhase 5

Post-ClosingPhase 1: Investigate Market Opportunities

Buyer & Seller Activities During Phase

- Assess market & industry specific M&A trends

- Track competitor deal activity

- Discussions with bankers

How AI Schema Works with Clients

- Gain more accurate conclusions at the earliest deal stages

- Gain new competitor insights

- Gain new data classifications that reveal hidden deal truths and patterns

Phase 2: M&A Opportunity Emerges

Buyer & Seller Activities During Phase

- Define M&A opportunity and options to act (buy, sell, do nothing?)

- Analyze business case for each option: ROI & cost/benefit

- Choose to implement M&A solution

How AI Schema Works with Clients

- Gain better predictive powers on deal uncertainty

- Gain new methods to test assumptions conditionally

- Use asymmetric deal information to your advantage

Phase 3: Internal M&A Deal Planning

Buyer & Seller Activities During Phase

- Organize internal and external deal teams, solicit advice

- Formulate strategic plan and key deal terms

- Assess deal conditions and potential counterparty

How AI Schema Works with Clients

- Gain new ways to judge future deal term success

- Gain more accurate conclusions earlier for strategic planning purposes

- Gain new insights on outside adviser M&A track records

Phase 4: Deal Execution

Buyer & Seller Activities During Phase

- Counterparty selection process

- Propose deal terms, generate counter proposals

- Finalize business, finance and legal issues – close deal

How AI Schema Works with Clients

- Gain new predictive powers on counterparty selection process

- Gain new ways to test validity of counter proposals made

- Gain new negotiating power

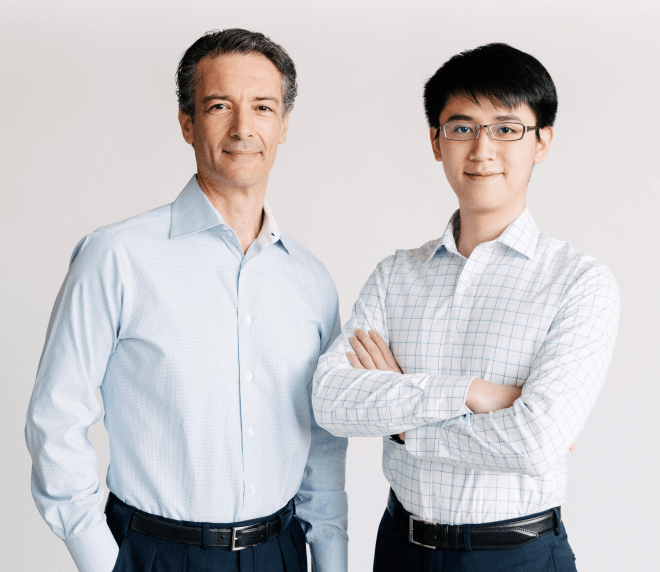

Leadership

Nir Yarden

Co-FounderHaoran Li

Co-Founder

Nir Yarden

Co-FounderMr. Yarden is a Co-Founder of AI Schema. Trained as a lawyer and investment banker specializing in financial institutions work, Mr. Yarden has advised some of the largest global financial institutions and investors on numerous M&A and investment matters. His work experience includes having been an economics research assistant for Judge Richard Posner and an attorney at Skadden, Arps, Slate, Meagher & Flom, LLP.

Mr. Yarden received a B.A. in Economics (with Honors) and an M.B.A. in Finance from the University of Chicago and a J.D. from Duke University School of Law. He was born in Jerusalem, Israel.

Haoran Li

Co-FounderMr. Li is a Co-Founder of AI Schema. He is an accomplished Data Scientist with a demonstrated history of working across multiple industries. Mr. Li specializes in data engineering, machine learning (supervised/non-supervised, NLP, personalization system), large scale distributed system, and data visualization. He implements applications of AI and advanced data analytics to achieve business outcomes.

Mr. Li received a B.A. in Applied Mathematics from University of California – Berkeley and an M.S. in Data Science from Columbia University. He was born in Anhui, China.

Get in Touch

We appreciate your interest in AI Schema.

Contact

AI Schema, Inc.

888 7th Avenue, Suite 602

New York, N.Y. 10019

info@aischema.com